$1.7 Trillion & Six Hours: Black Wealth, Fragmented Capitalism, and the Urgent Call for Community Economics

Share

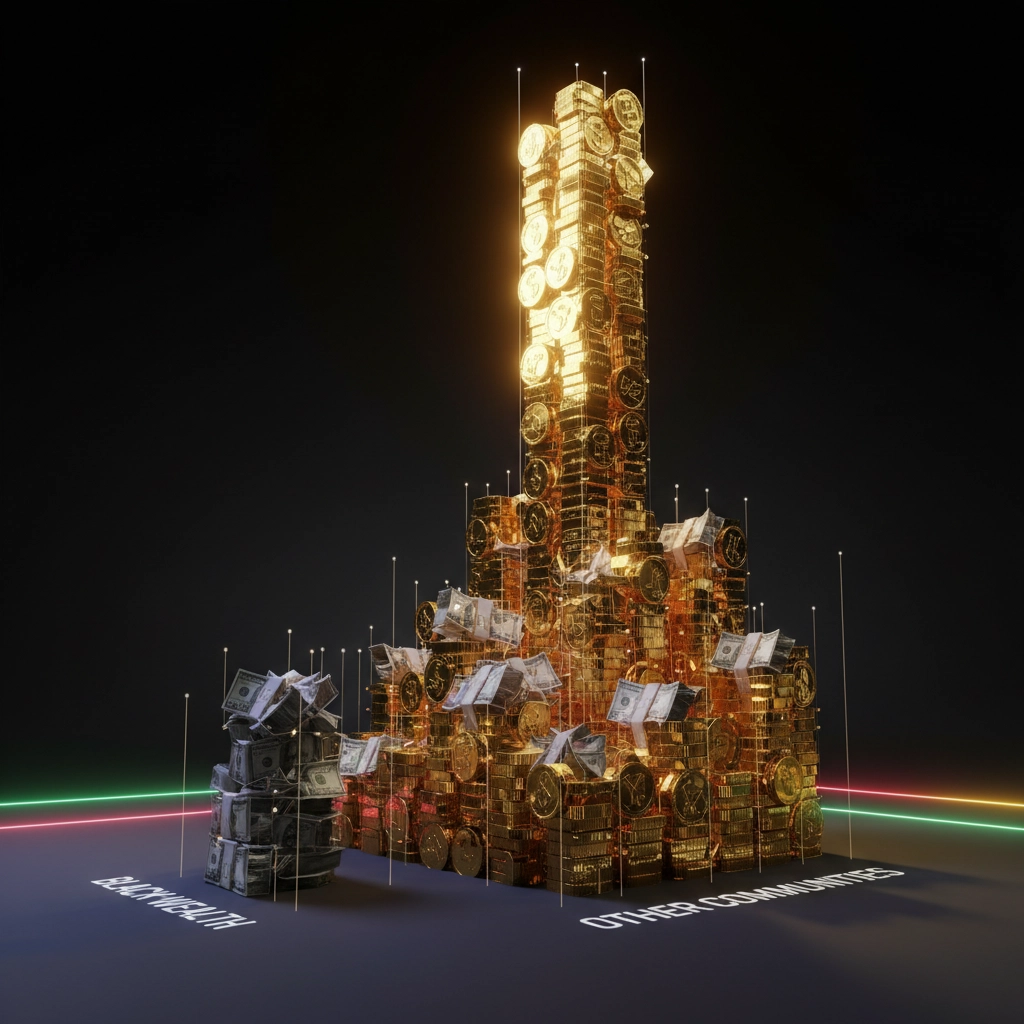

Let's talk real talk for a minute. We got $1.7 trillion in buying power as Black Americans. Trillion. With a T. That's more economic muscle than most entire countries. But here's the kicker, that money disappears from our communities faster than a sneaker drop sells out. We're talking six hours, family. Six hours.

While other communities hold onto their dollars for weeks, sometimes months, building wealth hand over fist, we're out here running a financial relay race where we keep dropping the baton.

The Numbers Don't Lie: We're Economic Giants Living Like We're Broke

The Federal Reserve laid it out plain as day in their 2022 Survey of Consumer Finances: 54% of Black families have less than $800 in savings. Read that again. More than half of us couldn't cover a basic emergency without going into debt or asking family for help.

Meanwhile, we're collectively spending $1.7 trillion annually. That's real economic power right there, the kind that built entire industries and made fortunes for everybody except us.

Compare that to our counterparts:

- Asian American families: Median savings of $8,200

- White families: Median savings of $4,500

- Jewish communities: Studies show money circulates 19-20 times within the community before leaving

- Black families: That $800 we mentioned, gone in 6 hours

The Economic Policy Institute broke it down even further. While we represent 13.4% of the population, we hold only 2.6% of total U.S. wealth. That's not just a gap, that's a canyon.

The Six-Hour Exodus: Where Our Money Goes to Die

Here's where it gets painful. According to Nielsen's extensive research on Black consumer habits, Black dollars circulate in our communities for an average of 6 hours. Six. Hours.

Jewish communities? Their money stays local for 19-20 days. Asian communities keep theirs circulating for weeks. Even in predominantly white suburban areas, consumer dollars bounce around local businesses 6-20 times before heading elsewhere.

But us? We spend our money, and it's ghost. Gone to businesses that don't hire us, don't invest in our neighborhoods, and definitely don't have our backs when things get real.

Think about your last shopping trip. How many Black-owned businesses did you hit up? How much of your grocery money, your clothes budget, your tech purchases stayed in the community? If you're honest, probably not much.

The Permanent Underclass Warning: They Said It, Not Me

The Institute for Policy Studies and Prosperity Now released a report that should've been a wake-up call heard 'round the world. They projected that by 2053, yeah, just 30 years from now: median Black household wealth will hit zero. Zero, family.

The "Road to Zero Wealth" study laid out the timeline:

- 2019: Median Black wealth at $17,600

- 2031: Projected to drop to $12,000

- 2053: Complete wealth elimination

Meanwhile, white median wealth is projected to grow from $171,000 to $174,000 during the same period.

The Brandeis University study on racial wealth gaps put it even more bluntly: without dramatic intervention, Black Americans are headed toward becoming a "permanent underclass": economically isolated and dependent.

How Other Communities Lock In Their Wealth

Let's study the playbook, because other groups didn't get wealthy by accident:

Korean Americans: The "kye" system: rotating credit associations where community members pool money to fund businesses and homes. Result? Koreatown in LA generates over $3 billion annually.

Jewish Communities: Strong emphasis on supporting Jewish-owned businesses, banks, and investment funds. The Jewish community's economic solidarity helped build entire industries from entertainment to finance.

Italian Americans: Used community-based lending and business partnerships to establish strongholds in construction, food service, and real estate.

Chinese Communities: Tontines and community credit systems that keep money local and fund the next generation's education and business ventures.

Each of these groups understood something we've forgotten: economic power comes from economic cooperation.

The Fragmented Capitalism Trap

Here's the truth nobody wants to say out loud: we're practicing fragmented capitalism. We've got all the spending power but none of the ownership. We're consumers, not capitalists.

The Bureau of Labor Statistics shows Black Americans spend disproportionately more on:

- Apparel: 23% more than average

- Personal care: 18% more than average

- Housing: Often in communities we don't own

- Transportation: Cars we finance but don't manufacture

We're keeping everybody else's economy strong while ours stays weak. That $1.7 trillion is building wealth: just not for us.

Breaking the Cycle: It's Time for Economic Nationalism

The solution isn't rocket science, but it does require discipline:

Buy Black First: Before you spend anywhere else, ask if there's a Black-owned option. From groceries to gas stations, from accountants to attorneys.

Bank Black: Move your money to Black-owned banks and credit unions. They're more likely to approve loans in our communities and invest in our businesses.

Invest in Us: Support Black businesses beyond just buying products. Invest in Black-owned startups, real estate, and investment funds.

Teach the Next Generation: Financial literacy isn't just about budgeting: it's about understanding wealth building and community economics.

The Nagast Way: Economics Through Culture

This is exactly why we started Nagast Footwear. We're not just selling sneakers: we're promoting a philosophy of Black economic empowerment through every step you take.

When you buy from Nagast, you're participating in circular Black economics. Your money stays in our community longer, funds more Black jobs, and builds the kind of generational wealth our ancestors dreamed about.

Our Pan-African designs aren't just fashion statements: they're declarations of economic independence. Every pair represents a choice to break the 6-hour cycle and start building something that lasts.

The Bottom Line: We Can't Keep Playing Small

We've got $1.7 trillion in economic firepower, but we're using it like a water gun instead of a cannon. The math is simple:

- If we kept just 10% of our spending in Black-owned businesses, we'd create 1 million new jobs

- If Black dollars circulated just twice before leaving (instead of 0.5 times), we'd double our community wealth in a decade

- If we matched other communities' savings rates, median Black wealth would jump from $17,600 to over $75,000

The choice is ours. We can keep feeding other people's economic engines while ours sputters, or we can finally use our collective power the way our grandparents dreamed we would.

The revolution starts with your next purchase. Make it count.

Ready to be part of the solution? Check out our latest collection and step into economic empowerment, one Nagast at a time.